The Canadian home products market is evolving, and so is the shopper journey. While trust, familiarity, and pricing remain key decision drivers, home products shoppers in 2025 are increasingly open to switching brands. With 30% exploring multiple retailers before making a purchase, marketers need more than just broad appeal—they need local relevance and sharp strategy.

In this blog, we explore how Canadian home brands can engage comparison shoppers, reduce churn, and boost in-store results through data-driven marketing.

Brand-Aware, Not Brand-Loyal

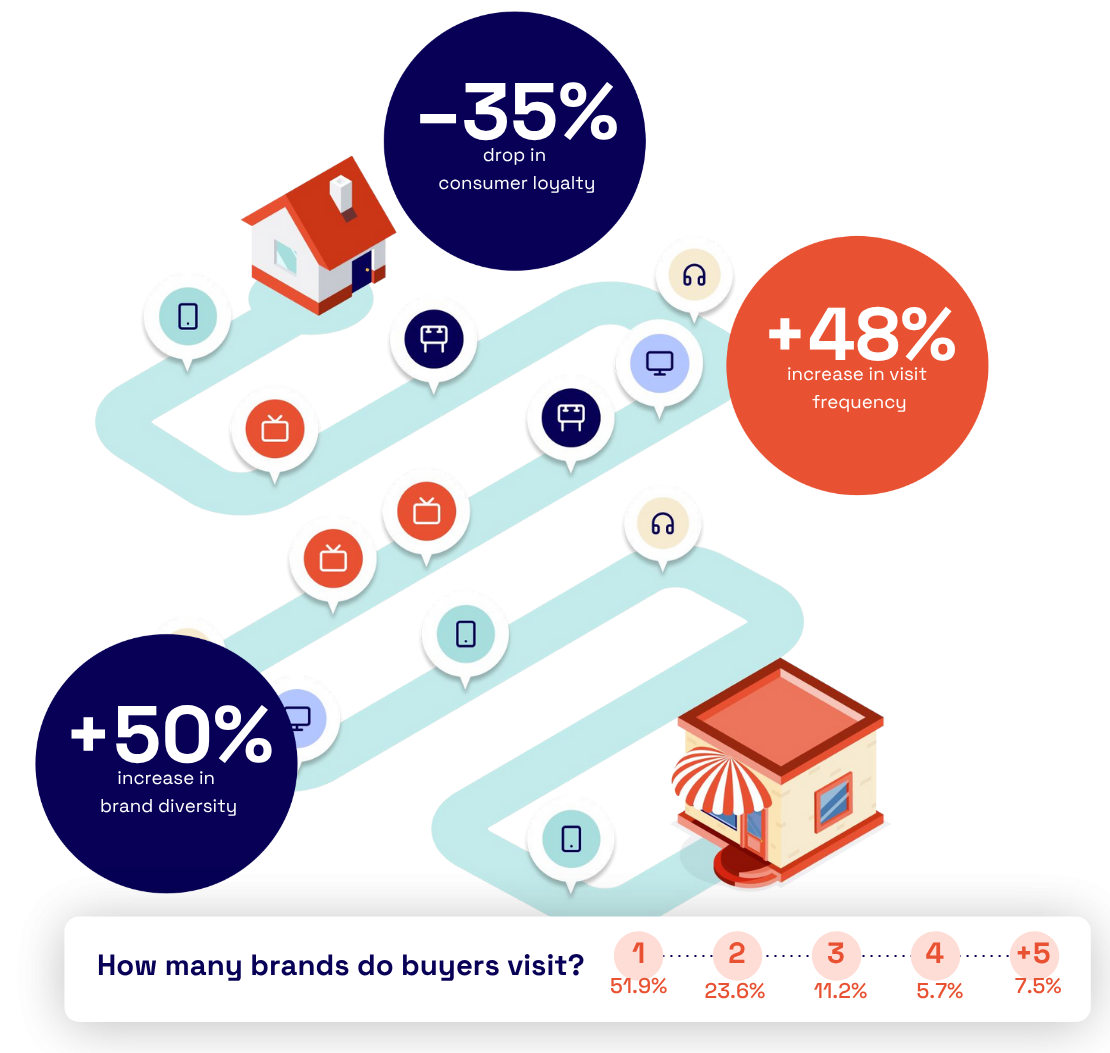

Shoppers tend to be brand-conscious, but not brand-committed. In 2025:

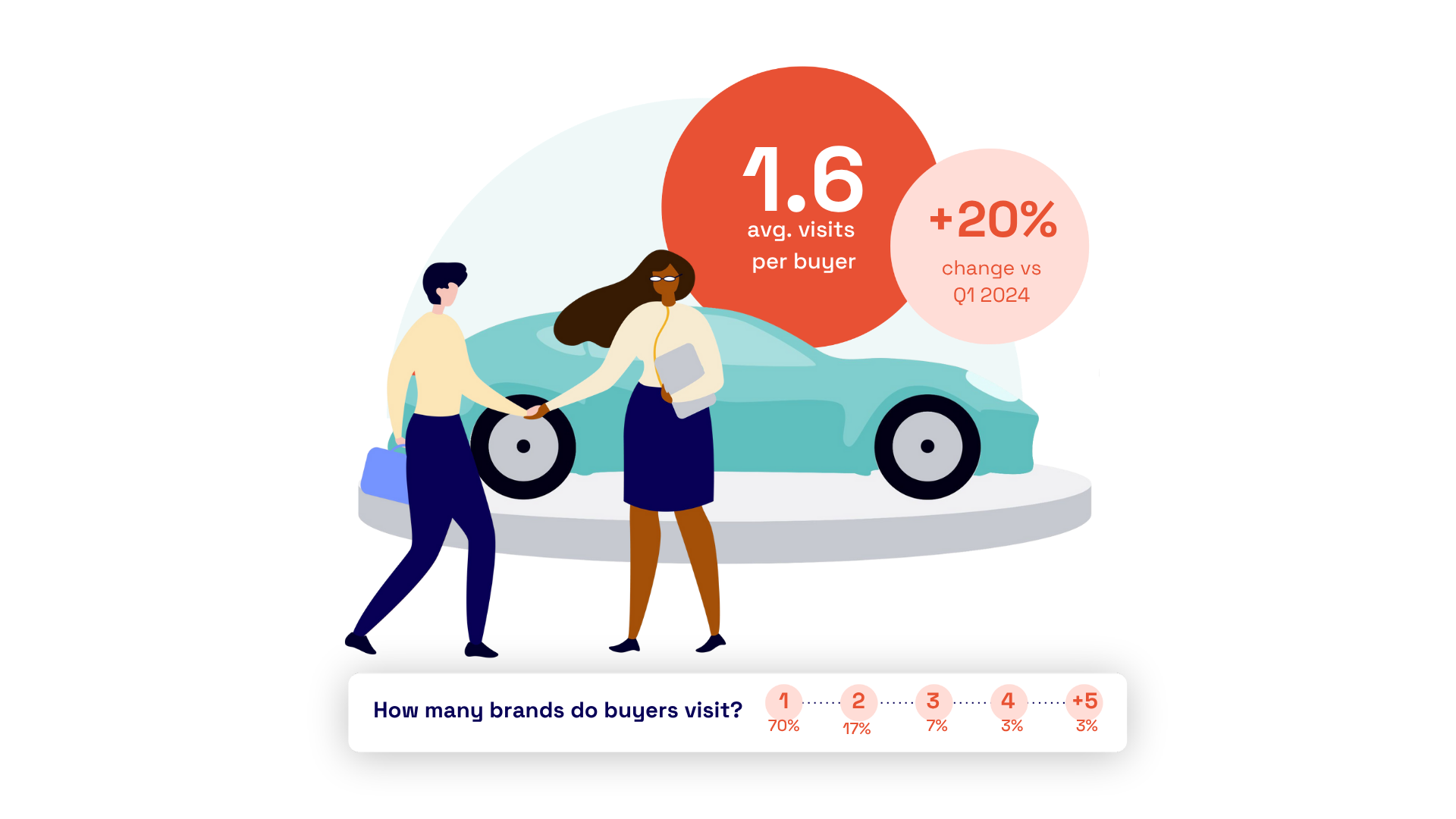

- 30% of shoppers visit two or more home brands before committing to a purchase.

- The average buyer browses 1.5 brands during their path to purchase.

- 14% of store visitors are switch-minded—actively open to a better offer or shopping experience.

These switch-minded shoppers may seem like a minority, but they represent a significant lost opportunity if not addressed. And with loyalty hanging by a thread, one strong competitive message could cause churn.

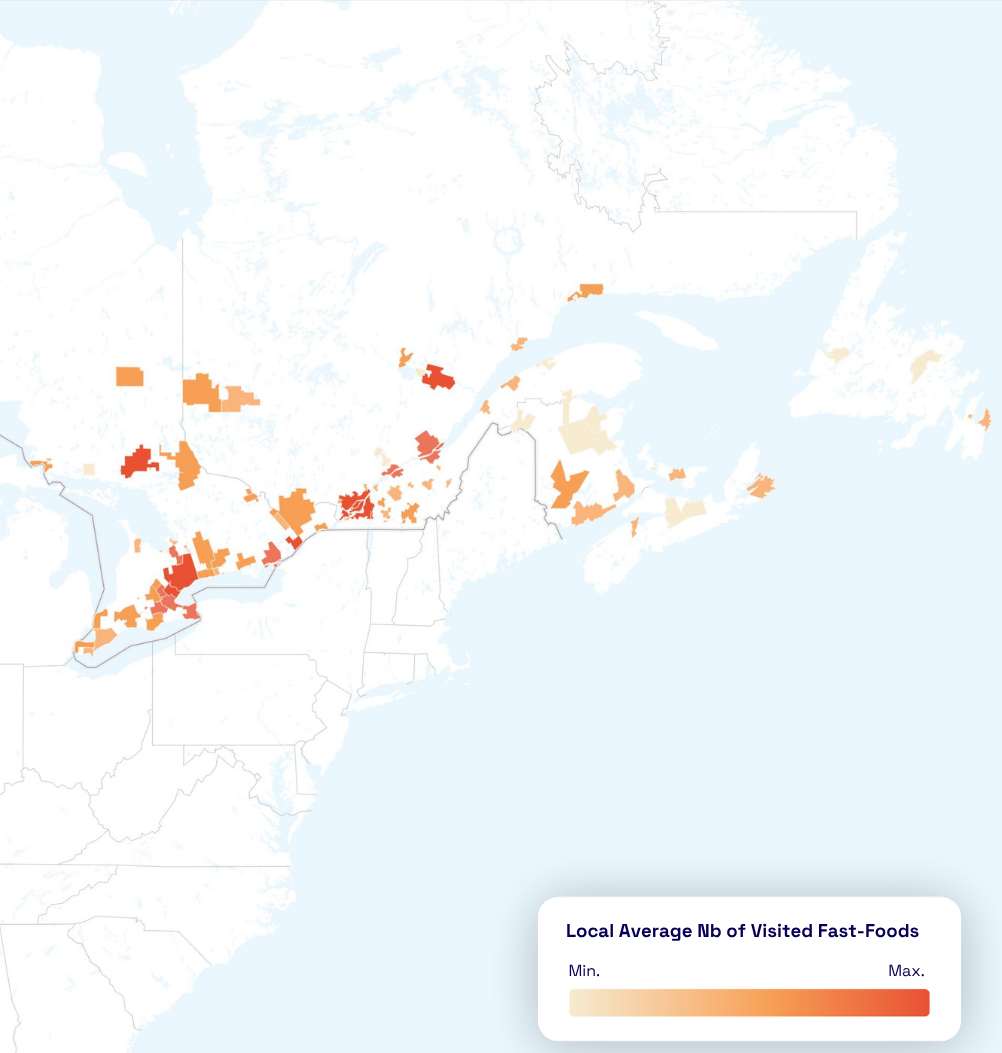

Why Local Context Matters More Than Ever

Across Canada, from urban Toronto condos to rural Nova Scotia homes, consumer behavior varies widely. National campaigns that ignore local preferences and shopping trends fail to connect at scale.

By tapping into local funnel shifts, brands can optimize their strategy based on regional engagement levels, shopping habits, and audience dynamics. This means customizing:

- Media delivery timing by province or metro area

- Creative messaging for specific demographics

- Audience segments that reflect true local demand

- Budget allocation tailored to high-potential store zones

Winning Canada’s 14% Switch-Minded Shoppers

Even in a market known for its loyalty, competition is fierce. To win the 14% who are open to switching, brands must stay visible, relevant, and persuasive, especially at the local level.

Here’s how:

- Prioritize local behavior data in campaign planning.

- Segment and personalize offers by audience type and region.

- Test and optimize your strategies continuously.

- Invest store-by-store to maximize impact where it matters most.

Whether you’re launching a nationwide promotion or revamping local in-store traffic, data-led decisions ensure you don’t just capture interest, you convert it.

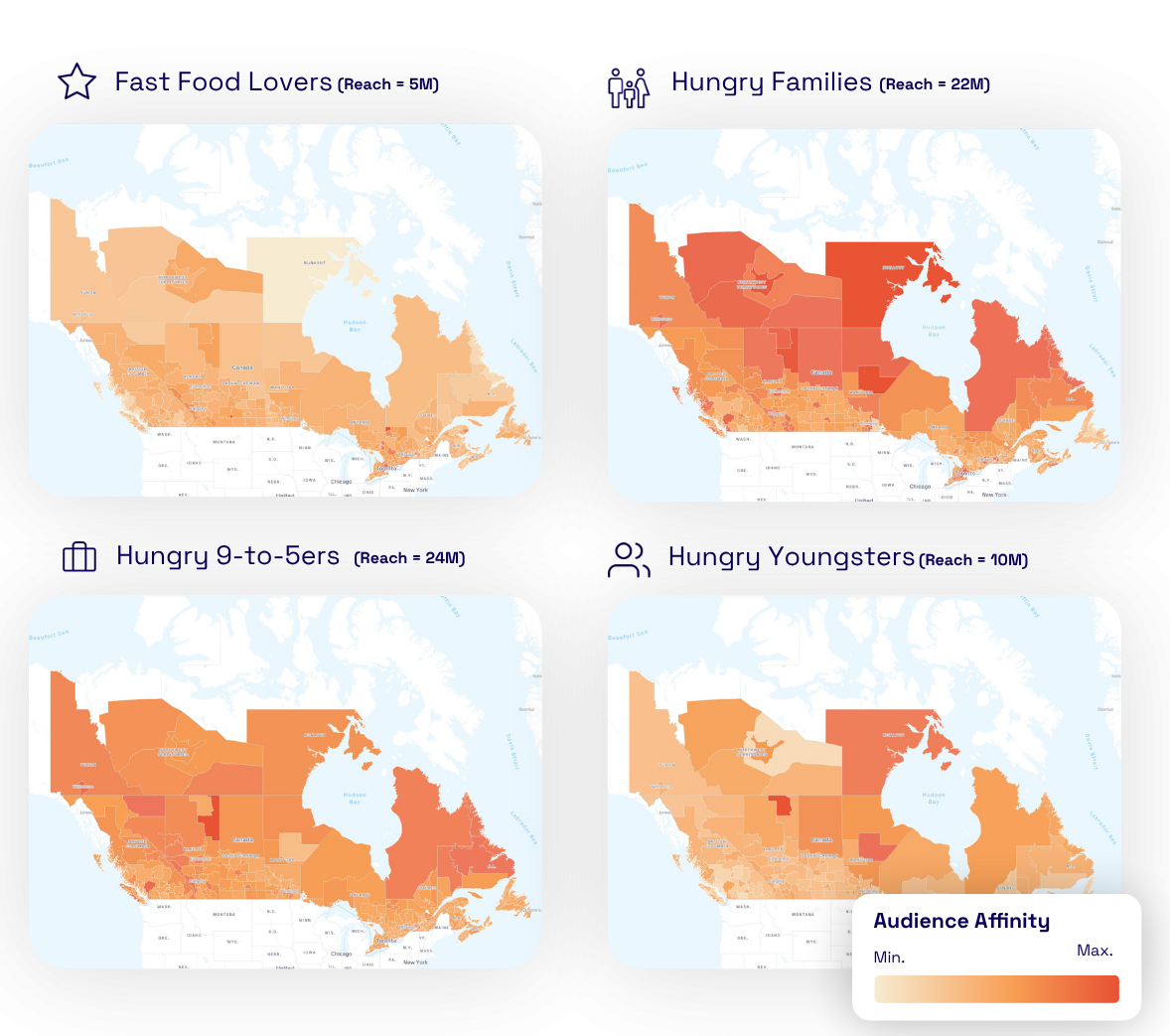

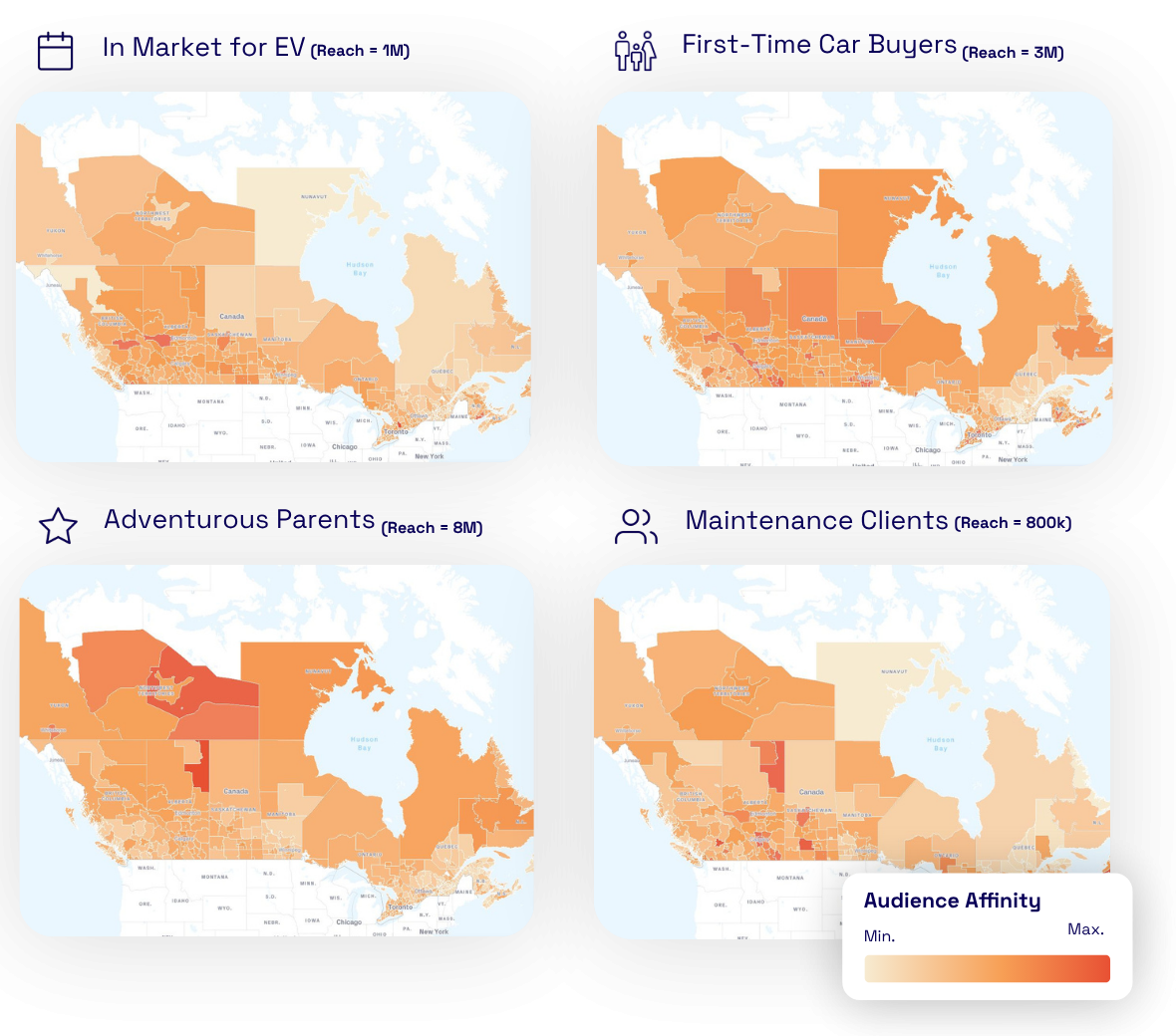

High-Value Audiences to Watch in Canada

Canadian home products shoppers are not a monolith. To drive growth, focus on audience segmentation and real behavior patterns. Top-performing groups in 2025 include:

- DIY Store Weekend Regulars.

- Furniture Cross-Shoppers

- Small-Space Décor Upgraders

- Four-Bedroom-Plus Residents

- Suburban Family Homeowners

Campaign Results That Speak Volumes

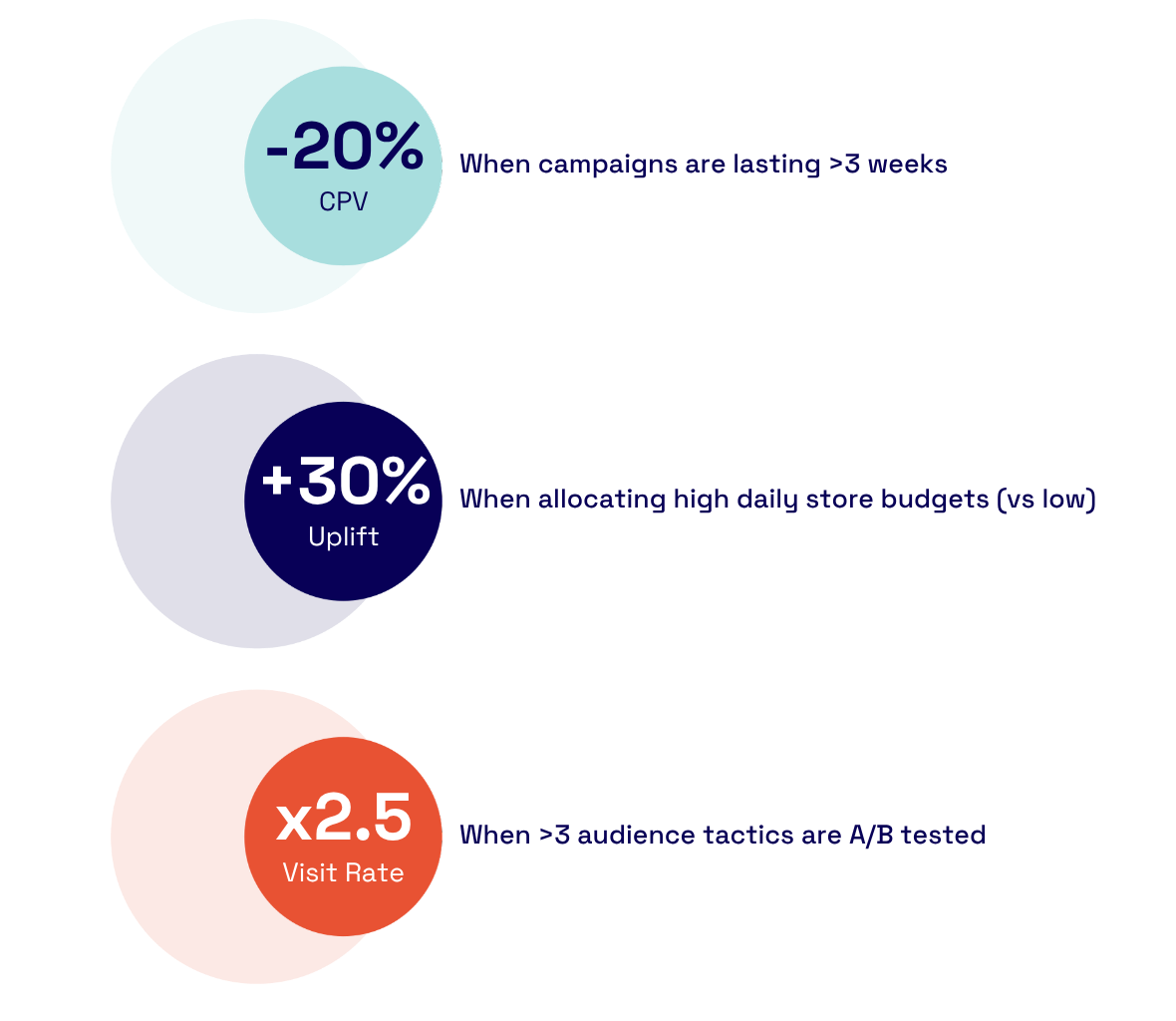

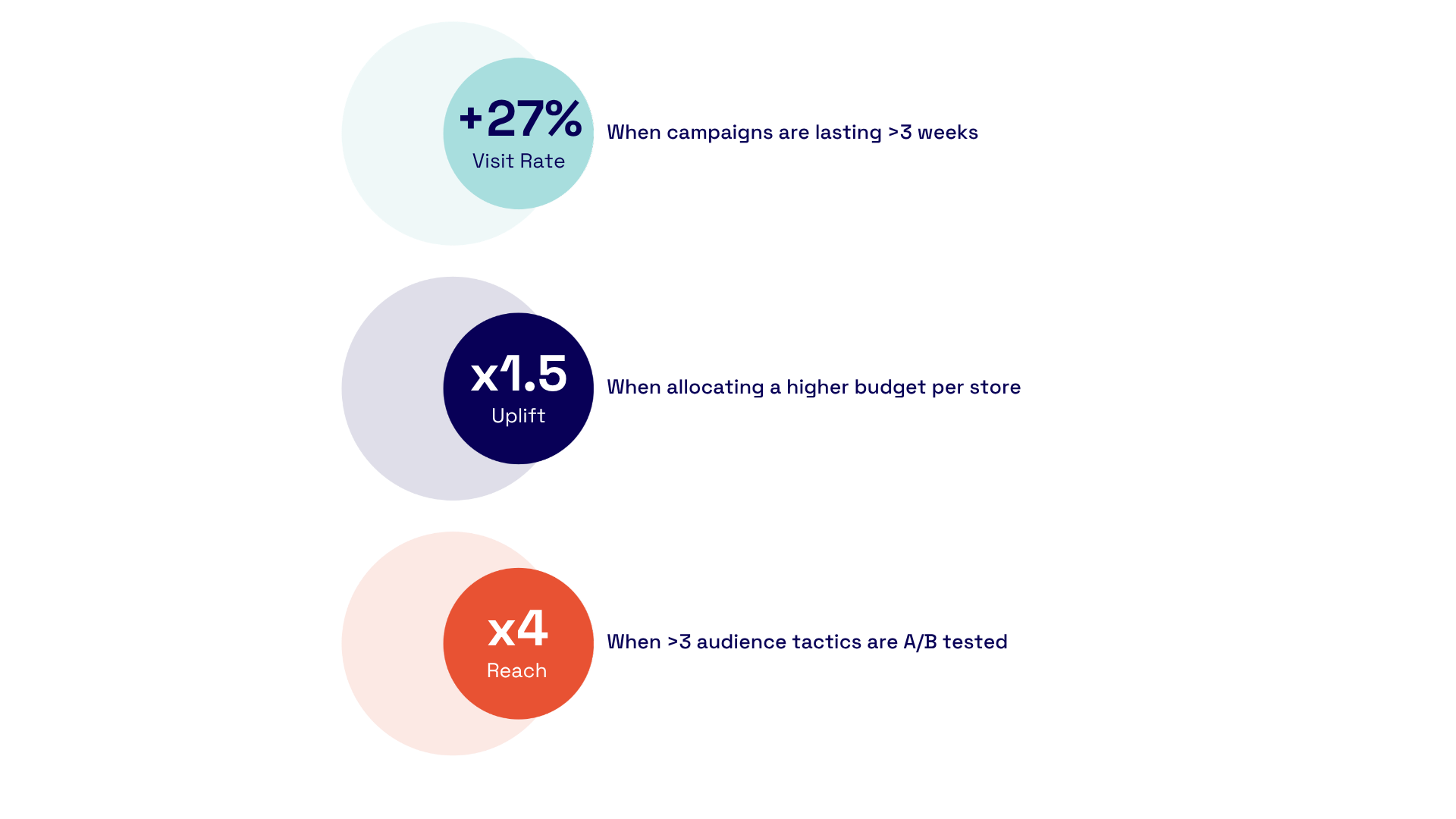

With over 380 campaigns across 30+ brands in 12 markets, Locala knows how to turn data-driven insights into impactful, localized marketing strategies that deliver real results:

These metrics highlight the impact of precise, audience-first planning backed by localized data and continuous optimization.

Stay Ahead of the Shifting Shopper Landscape

Looking for deeper insights? Explore our latest updates and book a demo to see how Locala empowers brands to drive foot traffic, win new buyers, and retain loyal ones across Canada.

These groups aren’t just marketing personas. They represent real, actionable audiences that are actively engaging in the market.

These groups aren’t just marketing personas. They represent real, actionable audiences that are actively engaging in the market.