I’ve shipped more insight decks than I can count. Some were genuinely sharp: clean maps, tidy funnels, a couple of “aha” overlaps between market intelligence and audience patterns. People nodded. Screenshots got copied into eleven other documents. Then… nothing changed. Budgets didn’t move. No new tactic went live. I don’t regret the craft, but I do regret the outcome: pretty narratives with no operational spine.

If that sounds familiar, you’re not alone. In the real world of the AAA trinity (advertiser, agency, adtech), it’s the simple, practical stuff that kills momentum.

- You go hunting for the one audience the deck depends on (say, “switchers near priority stores from the last 90 days”) and discover it’s named differently or doesn’t exist across partners: a third-party segment in one DSP, a 6,000 users lookalike somewhere else, a taxonomy that maps poorly, and often.. x3 the CPM.

- Then the geo-targeting: the plan says “12-minute drivetime around these places”, but your platform only supports postcodes, so someone spends a day hand-building circles on a map, cleaning duplicates, reformatting place lists, and re-uploading after a reject.

- Meanwhile you’ve promised to adapt locally (let’s say, by city), but you don’t actually have fresh insights on your own brand per market, so “localization” becomes guesswork and templates.

By the time audiences, geos, and “we’ll tailor per sub-goal” are reconciled, the campaign has likely ended. At Locala, we’ve had the time (and scars) to study why this happens and, with that maturity, we rebuilt our approach so the work doesn’t stall between “insight” and “go live.” The short version: we stopped optimizing for great slides and started engineering for time-to-flight.

What “insight decks” get wrong (and why most plans stall)

Over the years, I’ve seen three very common planning traps across digital advertising, not Locala-specific, just industry-standard habits that quietly kill momentum:

1) Treating audiences as the brief. Plans that start and end with “Who’s our audience?” ignore the real brief: the business job by market. The job changes block by block, defend leadership here, grow there, conquest across that corridor. If the question changes by place, your audiences, budgets, messages, and surfaces must change too. Audience is the answer, not the brief.

2) Splitting one insight per slide instead of building a unified view. A chart of traffic share vs competitors. A map of cross-visitation. A table of affinity scores by categories. Useful on their own; misleading in sequence. Strategy needs everything in one frame at once: brand + competitor, macro + granular, audiences + channels, so you can resolve conflict and trade-offs before you touch a budget.

3) Stopping at “interesting,” which is hard (or impossible) to activate. “Interesting” doesn’t move a pixel. Only mandates do: where to lead/defend/grow/conquest, how to weight budget by tier, which channels unlock the job, which audience to talk to, geo-targeting to deploy, which creative to rotate. If a finding doesn’t collapse into a rule I can push to activation easily, it’s more of a nice slide than a useful strategy.

Locala’s evolution: from “interpret these” to “switch this on”

I’ll be direct about us. For years, audiences sat on one side and market insights sat on the other. Even with our great and innovative planning approach, we still asked teams to bridge the last mile: interpret, rebuild, and re-enter it all in activation tools.

Two things happened at once that changed our posture (and mine). We onboarded our online dataset, finally letting us see digital signals next to real-world ones and I moved from Insights Manager to Product Marketing. Perfect timing. I could take the learnings from insight-only workflows and turn them into product requirements: one place for truth, fewer handoffs, and a plan that doesn’t stall between “interesting” and “live.” That’s the moment we decided to stop shipping decks and start shipping decisions you can switch on.

The product principles that birthed Omni Planner

When Baptiste Bernard and I started sketching the earliest concepts, I asked one annoying question on repeat: “How do we translate so many signals into something anyone can grasp, and that actually guides the next step?” (we’re talking billions of signals here). The answer couldn’t be “another dashboard.” It was leading us to a different way to build our solutions:

- Activation-first. Begin at the end. What media decision should this view produce, and how do we push it live in a single motion?

- Automate the bridge. Shrink the gap from planning to activation, no downloads, no manual rebuilds across platforms.

- One home for truth. Regroup all brand insights and audience intelligence so all the learnings we need are centralized, and tactics are applied in one place.

We also had to unlearn an old reflex: adding features to show more insights. In adtech, that’s friction. The new rule we hold ourselves to is simple to say and hard to build: if the tool can read a signal, it proposes the next step and makes it easily pushable.

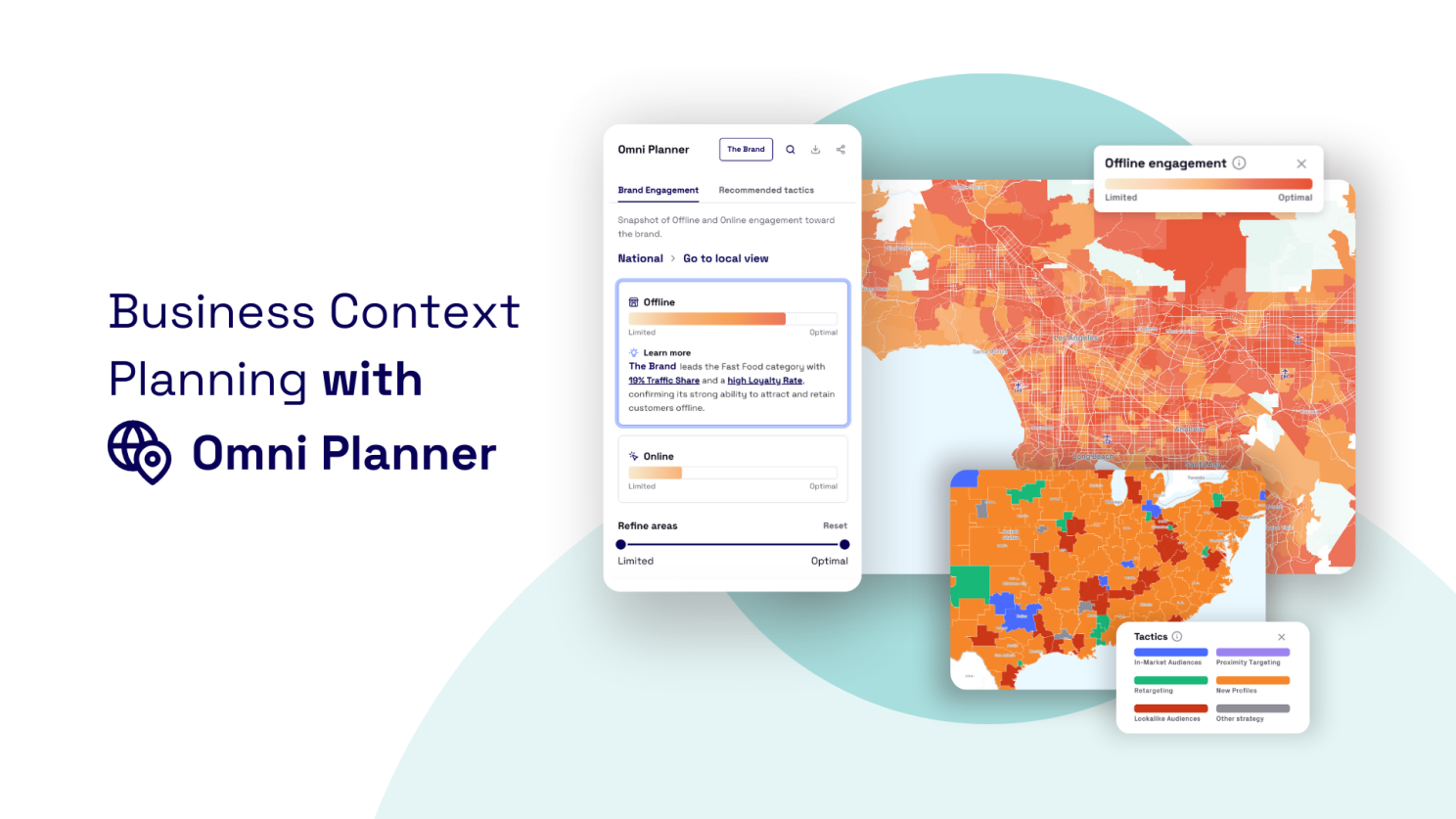

The result is Omni Planner: our On & Off unified view and location-based advertising expertise expressed in a single feature. It puts market context and audience logic on the same rail, and it’s opinionated about what to do next using machine learning. That’s not only a nicer UX, it’s us reinventing the space so strategy and activation finally live together.

The Omni Planner shift

1) Unified + Granular Benchmarks Everything sits together: brand + competitor in the same view, from global context down to local markets. You see the whole picture at once, no slide-by-slide archaeology, so trade-offs are resolved before a single euro or dollar moves.

2) Insights → Activation (built-in) When Omni Planner reads a signal, it interprets the business context meaning and translates it into the next step automatically. That means:

- Allocate where needed with explainable weights tied to business reality.

- Propose the right, business-driven audience mix (e.g., loyalists to sustain, lapsed to re-engage, competitive switchers to win back) derived from local context, not a generic 25–54yo.

- Auto-build geo-targeting from real movement (trade areas, competitors POI..) instead of arbitrary circles or postcode hacks.

- Output everything in a pushable format (audiences, shapes, pacing, mixes) that DSPs can ingest, to cut “time-to-flight” from weeks to hours.

Because brand insights and audience insights live together, the path from “we’re underperforming here” to “we’re live with a better plan” is just one step.

TL;DR

What changes for our advertisers, concretely starting now:

- Time-to-flight → Hours, not weeks. Brief in, decisions out, campaigns live, without rebuilding yourself in five tools.

- Ease-to-flight → One motion. Omnichannel signals in one place, translated to tiering, budgets, audiences, geo-areas, and channel stacks you can push.

- Decision coverage → Most of your spend governed by explicit rules. Fewer “custom one-offs,” more repeatable success.

What we do differently:

- We don’t sell generic audiences divorced from the job.

- We don’t accept arbitrary circles that ignore real mobility.

- We don’t pretend a single national plan is “local” because the slide title says so.

- We don’t call a chart “strategy” unless it resolves into a rule with a path to activation.

Why this matters now: IDs fragment, lookalikes converge, platforms abstract what used to be visible. The answer shouldn’t be “collect more signals.”, but to express a sharper point of view per market, and wire that POV into the tools that spend your money.

With Omni Planner, brand + competitor, global + hyperlocal, unified + smart live in one place, and the tool translates signals into next steps you can push. That’s what we’re building at Locala. If you’re stuck in the “insights that don’t move” loop, send us a brief. I’ll bring a plan that flips the default from tell me more to turn it on.