MMMs provide the national blueprint. But driving growth across a country means translating that strategy with actionable Media Receptivity signals.

Every media strategist I speak with in France values their Marketing Mix Model (MMM). For years, these models have been the bedrock of strategic budget allocation, providing a data-driven view of how to distribute spend across channels on a national scale. They are essential tools for marketers conversations, linking investment to outcomes.

But I consistently hear the same follow-up question: “How do we make our national plan actually work in Marseille, Lyon, or the suburbs of Paris?” adapted to on-the-ground realities.

That’s the challenge. An MMM provides a brilliant national blueprint, but it’s built on averages. It smooths out the rich, geographic textures that define how consumers actually engage with media. A plan that treats all of France as a single entity risks succeeding on average, but failing in the specific places that matter most.

The truth is, national strategies don’t fail because they are wrong; they underperform when they aren’t

The Limits of a National Compass

Think of an MMM as a high-level weather forecast for the entire country. It might correctly predict a mild, partly cloudy day for France as a whole. While accurate on average, it’s not particularly helpful if you need to decide whether to pack an umbrella for a meeting in Brest or sunglasses for a client lunch in Nice.

Marketing works the same way. Your MMM might recommend a 20% budget allocation to Connected TV (CTV) nationally. But what does that mean in practice?

- Does that 20% apply equally to the dense urban core of Lyon, where Digital Out-of-Home (DOOH) might be more impactful during commute times?

- What about in a sprawling suburban area around Bordeaux, where CTV penetration and viewership habits are completely different?

Applying a national average everywhere means you are almost certainly over-investing in some areas and under-investing in others. The “why” behind the strategy gets lost in translation, replaced by guesswork.

A New Layer of Intelligence: Media Receptivity

This is not a criticism of MMMs. It’s an argument for augmenting them. To bridge the gap between national strategy and granular execution, we need a new kind of signal, one that understands how media is consumed and, more importantly, acted upon at a more precise level.

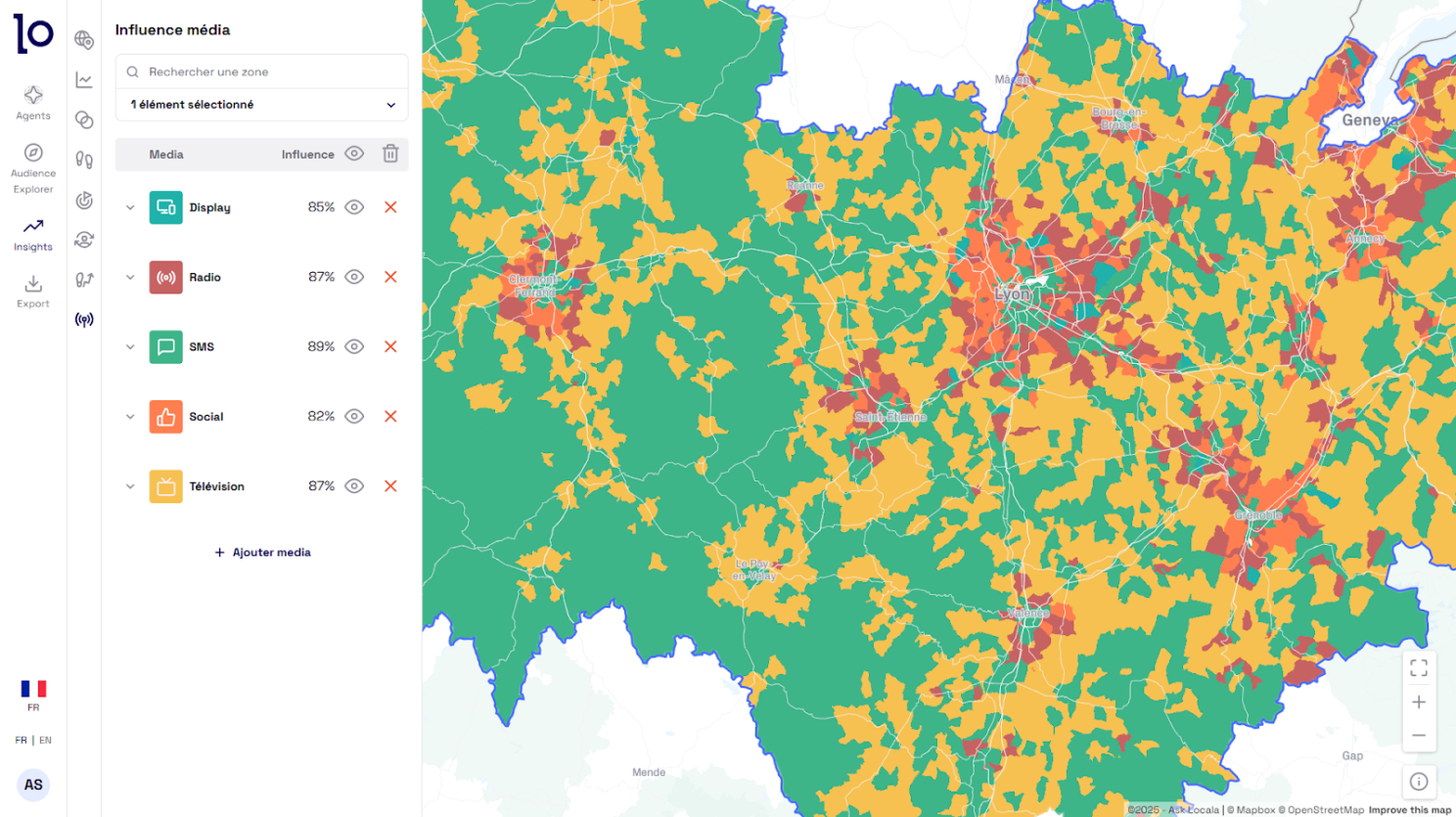

At Locala, we call this Media Receptivity.

It’s a signal that moves beyond simple channel consumption and answers the critical tactical questions your MMM can’t:

- For our target audience in Lille, is CTV or a geo-targeted Meta campaign more likely to drive consideration?

- In Strasbourg, what is the optimal mix of DOOH and mobile Display to intercept customers near our competitors?

Media Receptivity gives us the compass we need to navigate the nuances of each market.

From Theory to Practice: Two French Scenarios

Let’s make this concrete. Imagine a national auto brand launching a new electric vehicle. Their MMM suggests a heavy investment in digital video and social media.

- In the Paris Region: Our Media Receptivity analysis shows that for “EV Intenders” in the affluent western suburbs, CTV is indeed highly effective for building awareness. However, for a similar audience profile in the eastern part of the region,social campaigns on Meta drive significantly higher engagement and website traffic. The action: We re-weight the national budget, focusing CTV spend in the west and boosting Meta activation in the east.

- In Marseille: The same brand faces a strong regional competitor. Here, Media Receptivity reveals that the target audience is most receptive to DOOH advertising near key transit routes and competitor dealerships, combined with mobile retargeting. The action: We carve out a portion of the national budget to fund a conquesting campaign using a DOOH + Mobile mix, a tactic the national MMM would have overlooked.

In both cases, we aren’t contradicting the MMM; we are making it smarter and more efficient. We’re ensuring that every euro of the national budget is deployed in the channel where it will have the most impact, everywhere.

Driving National Success

The most successful brands we work with see this as a virtuous cycle. MMMs provide the strategic “how much.” Media Receptivity provides the tactical “where” and “how.”

- Plan Nationally: Use your MMM to set your strategic budget allocations.

- Activate with Precision: Layer on Media Receptivity insights to tailor the omnichannel media mix for your priority cities and regions in France.

- Learn and Refine: Measure the lift in both online and offline KPIs. This granular performance data can then become a powerful input to make your next MMM cycle even more accurate.

Geographic relevance is the engine of national performance. By aligning our media mix with the unique context of each city, we stop diluting our strategy and start building momentum where it counts. The result is a plan that is not only smart on paper but powerful in the real world.

Curious how Media Receptivity looks in your key markets in France? Let’s talk.