The era of one-size-fits-all planning is over.

Consumer behavior, competition, and mobility patterns vary drastically from one city to another. What works in London won’t work in São Paulo, because local context is what drives performance.

At Locala, we’ve seen this across countless international campaigns. Global strategies often collapse in execution because the local realities don’t match the global assumptions. That’s why we help brands integrate consumer behavior, competitive dynamics, and business context at a granular level, ensuring every activation reflects the true nature of each market.

Because the truth is simple: global performance is the sum of optimized local performances, executed at scale.

The problem with macro planning

Traditional planning follows a familiar pattern:

- define a global audience,

- replicate the same segmentation and media strategy everywhere,

- hope for consistent results.

It looks efficient on paper, but it ignores the where, and that creates three recurring blind spots.

1. Local audience potential

You can define a global audience, business decision-makers, high-net-worth consumers, loyal grocery shoppers, but their affinity, priorities, and routines vary widely city by city.

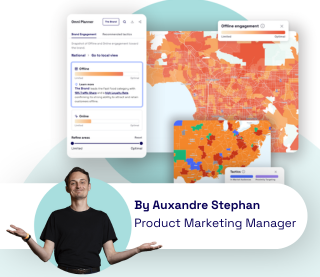

2. Local business context

Some cities are conquest markets with low awareness, Others are retention markets where the brand already has a foothold and competitive landscape will vary at a local level. Applying identical tactics to both dilutes performance.

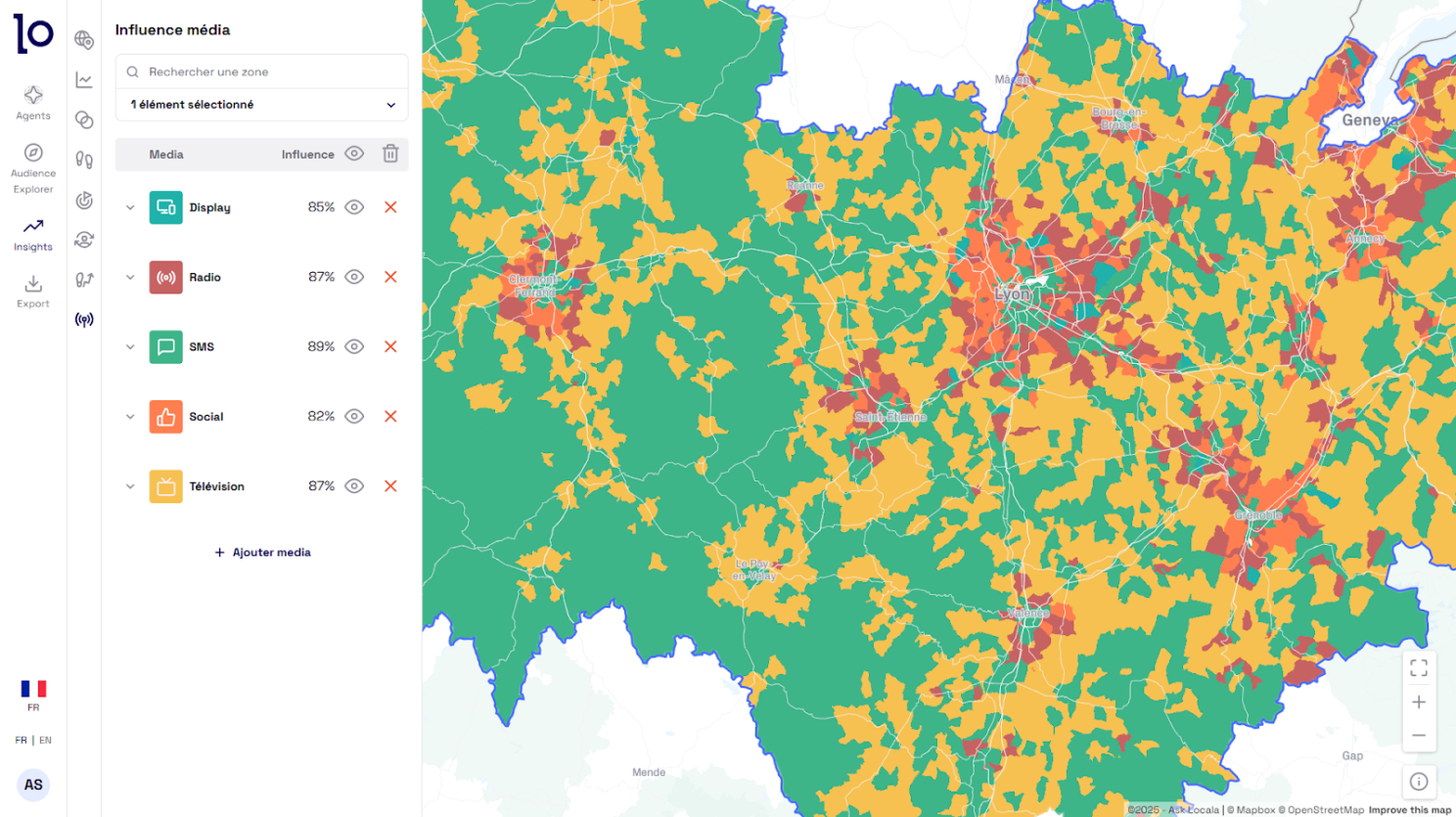

3. Local media ecosystems

Mobility patterns, media availability, competitive presence, every city has its own logic. A media mix that works in Paris can be irrelevant in Manchester or Dubai.

This is where global teams feel the most friction, everything aligns in the global deck, then unravels in local execution.

Local intelligence as a global enabler

My role at Locala is to make global ambition workable in the real world. And the most effective way to do that is through a simple yet powerful shift:

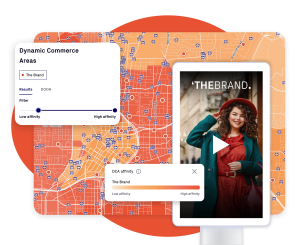

From “Who do we target?” to “Where does growth actually happen?”

Yes, a unified global audience remains essential, But the real performance uplift comes from optimising that audience locally, removing noise, integrating local signals, understanding competitive realities, and ensuring each market gets what it needs to succeed.

This is what brands come to us for, a partner that brings global cohesion and local precision.

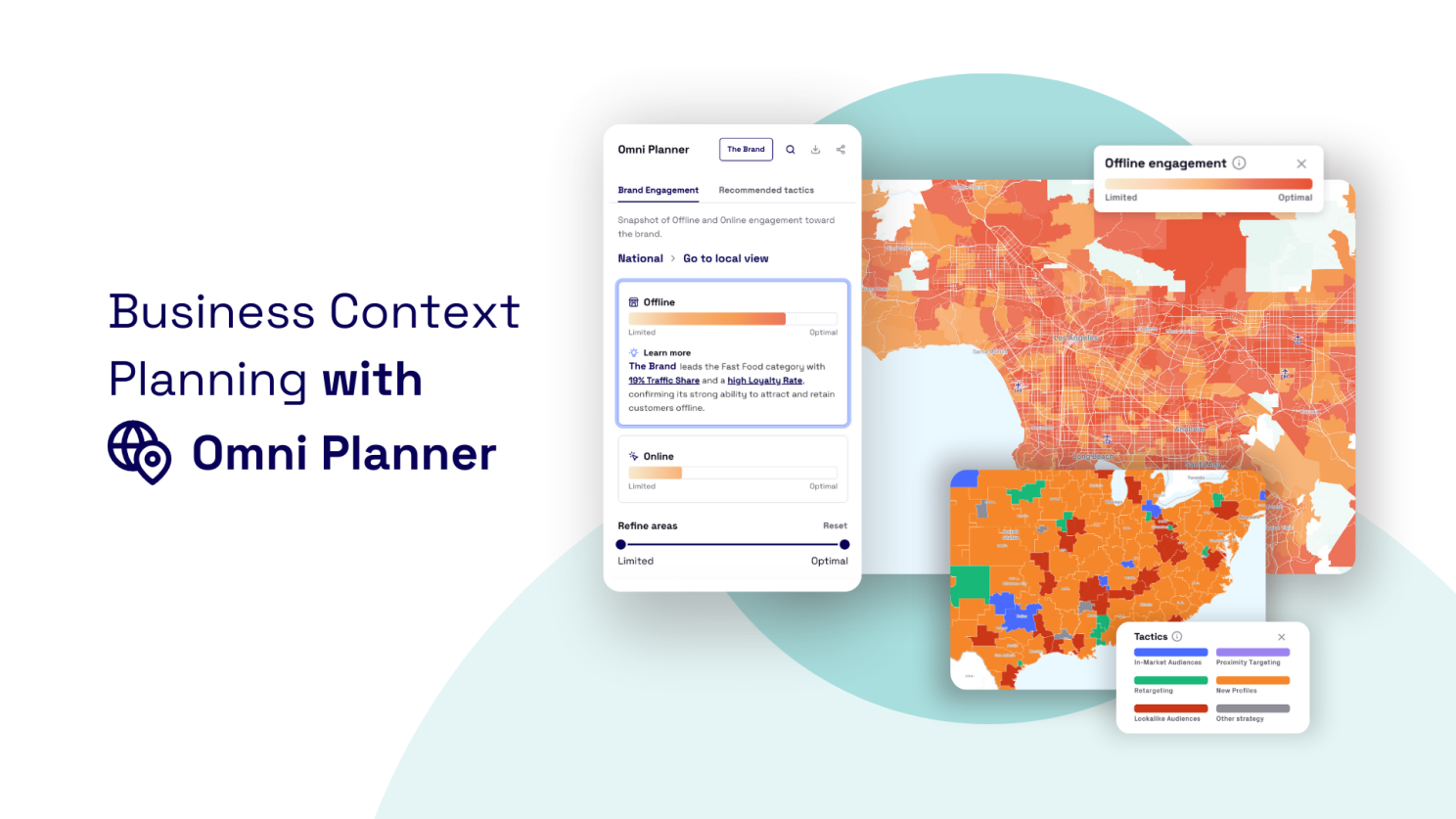

Global planning in practice: One methodology, many local realities

Over the years, I’ve had the opportunity to support global campaigns across industries, CPG, retail, real estate, tech, and more, sometimes for single-brand advertisers, sometimes for multi-brand groups. Whether activating across 5 markets or more than 50, the challenge is always the same:

How do you build a global audience that truly resonates in-market, and adapt it city by city?

In practice, this typically leads to two complementary approaches.

1. One unified global audience, locally adapted

You define one global audience, then refine it market by market based on:

- local mobility patterns,

- consumer profiles and behaviours,

- competitive context,

- relevant media touchpoints.

Same audience, thousands of local adaptations.

This keeps the global logic intact while respecting local realities.

2. Or multiple audiences built from local geo-behavioural signals

When markets differ significantly in maturity, competition, or consumer routines, the best option is to build:

- multiple audiences,

- multiple activation strategies,

- each rooted in local behavioural insights.

Ideal when each market requires its own growth logic.

Across all these international campaigns, one thing remains constant: global performance comes from aligning the strategy at the top while adapting the execution on the ground, without fragmentation.

The takeaway: global efficiency ≠ uniformity

Global efficiency doesn’t come from identical media plans. It comes from standardising the way you execute, while localising where and why you act.

The paradox is clear, the more you think local, the faster you scale globally.

The future of Adtech won’t be defined by mass targeting, it will be defined by understanding how one global audience behaves across dozens of different contexts, and adapting intelligently.

From audience to opportunity

Your targeting logic is now your competitive advantage.Treat every local area, every behavioural signal, and every zone of potential for what it is, unique.

If you’re navigating the tension between global ambition and local performance, I’ve been there.

Contact us to explore how local context can unlock your international growth.